What If Your Choices Created Ripples Across the Planet?

Have you ever stopped to consider how your daily choices might be affecting our planet? Many of us go through life without truly understanding the impact our lifestyle has on the world around us.

Would you be open to exploring a powerful question? How many Earths would we need if everyone lived exactly like you do today?

In my journey documented in "Lifestyle Medicine For the People," I discovered that environmental health and personal wellbeing are two sides of the same coin.

The 3 Major Challenges We're Here to Solve Together

- Feeling Disconnected From Our Impact: Most of us never see the full environmental consequences of our daily choices, leading to a profound disconnection from nature.

- Burnout From Consumption: The endless cycle of buying, using, and discarding doesn't just drain our planet—it exhausts our spirits and contributes to feeling unfulfilled.

- The Myth of Helplessness: Many believe individual actions can't possibly create meaningful change in the face of global environmental challenges.

Would you like to join a community of people who are finding their way back to connection with both themselves and the Earth? Our SelfCare tribe is exploring this journey together.

The SelfCare Framework: Learn-Do-Embody-Teach

Environmental wellness flows naturally through our four-step transformation process:

1. LEARN: Understanding Your Ecological Impact

Did you know that if everyone mimicked the average American consumption profile, as noted in the original article, we would consume five planets' worth of renewable resources every year? This isn't about guilt—it's about awareness.

As Sara Galentino, a PhD student from the University of Ferrara, shared in the original article: "Learning about Ecological Footprint really opened up my mind on available tools to measure our pressure on the planet... and the possibility to use it as an instrument to raise awareness and engage other people, too."

2. DO: Small Actions With Ripple Effects

What if I told you the most powerful environmental actions often align perfectly with practices that reduce stress and increase fulfillment?

The research is clear: mindful consumption not only lightens your ecological footprint but also relieves the burden of excess that contributes to feeling overwhelmed and unfulfilled.

3. EMBODY: Becoming What You Practice

Remember: you become what you consistently do. When sustainable choices shift from conscious efforts to unconscious habits, you're no longer just practicing environmental wellness—you're embodying it.

4. TEACH: Creating Ripples Beyond Yourself

Your transformed relationship with consumption naturally influences those around you, creating ripples that extend far beyond your individual footprint.

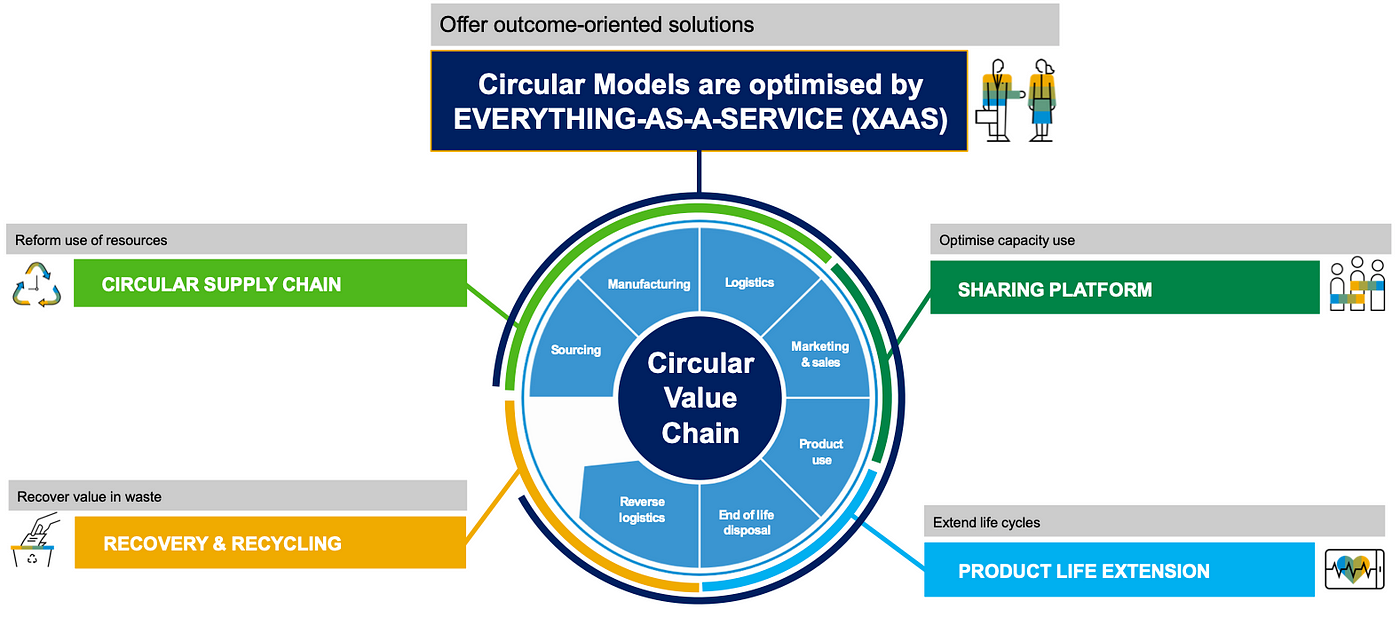

From Consumer to Steward: The Circular Mindset

Think about the last three things you purchased. Do you know where they'll end up when you're done with them?

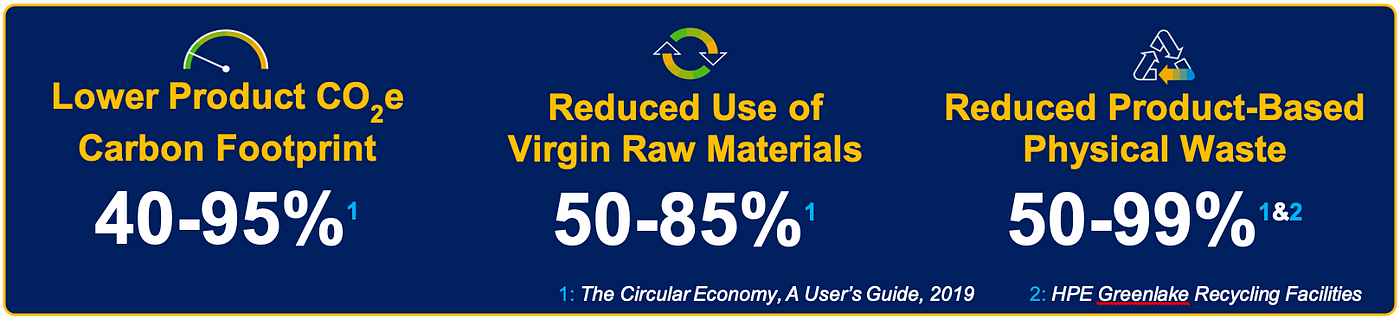

In our current system, less than 9% of materials are recycled globally. This isn't just an environmental crisis—it's a symptom of a deeper disconnection from what truly fulfills us.

The Ellen MacArthur Foundation's "Re-thinking Progress: The Circular Economy"

The circular approach challenges us to shift from being passive consumers to active stewards of resources. This mindset doesn't just benefit the planet—it addresses that emptiness that often comes from the endless cycle of buying and discarding.

May I ask—which feels more aligned with your deepest values: owning more things, or experiencing more joy from fewer, more meaningful possessions?

What If Business Changed Its Purpose?

Corporate leaders today face unprecedented pressure from all directions—customers, employees, investors, and society at large—to transform how they impact our world.

What if our economy shifted from selling products to selling performance? This seemingly subtle change creates a revolutionary alignment between business profit and planetary wellbeing.

When companies retain ownership of materials through servitization (providing services rather than selling products), they become motivated to:

- Design products that last longer

- Create items that are easier to repair

- Ensure materials can be reused and recycled

- Maximize value from each resource

Would you be curious to learn what happens when companies profit from durability rather than planned obsolescence?

Your Next Step: Discovering Your Ecological Footprint

The journey to environmental wellness begins with a simple question: How many Earths would we need if everyone lived like you?

This isn't about judgment—it's about illumination. Understanding your footprint is the first step toward meaningful change.

Would you take 5 minutes today to calculate your ecological footprint using the Global Footprint Network's calculator? You might be surprised by what you discover.

Remember: awareness creates the possibility for transformation.

Key Research References:

- Global Footprint Network. (2024). Ecological Footprint Calculator.

- Accenture. (2015). Waste to Wealth: Creating Advantage in a Circular Economy.

- United Nations Environment Programme. (2023). Global Resources Outlook.

REFERENCES

This is directly referenced from the Amazon best-selling SelfCare Book "Lifestyle Medicine For the People" by Rory Callaghan. If you would like to read more content like this, grab the free online chapters of the book or a hard copy.

We have done our best to reference everyone's expert opinions, peer-reviewed science, and original thoughts, all references available here and referenced in the text.

We also understand that most thoughts are not our own and there is a collective unconsciousness, unconsciousness, and universal mind stream of energy that is always at work. How our references are sorted and filtered is here.

This article is for informational purposes only and should not replace professional advice. Always consult with appropriate experts before beginning any new environmental or lifestyle practice.